Cover image via

Smartmockups (Edited by SAYS)

Subscribe to our Telegram channel for our latest stories and breaking news.

This Spotlight is sponsored by Gibraltar BSN Life Berhad.

Getting your first job, taking on new responsibilities, and gaining financial independence are all exciting prospects, but it certainly can get overwhelming.

Plus, the current worldwide situation doesn’t make things any easier as well. Other concerning factors include not having enough savings or insurance protection, causing you to be vulnerable to the financial impact following an unfortunate event. Ahh, adulting can be hard. :’)

Gibraltar BSN has been offering relevant and accessible protection solutions for over 60 years now, besides being one of Malaysia’s fastest growing life insurance companies.

The name Gibraltar BSN actually represents the company’s lineage to Prudential Financial, Inc.* (PFI), one of the largest financial institutions in the United States, and Bank Simpanan Nasional, an iconic brand every Malaysian knows with its own rich history and financial heritage in Malaysia.

*Prudential Financial, Inc. of the United States is not affiliated in any manner with Prudential plc, a company incorporated in the United Kingdom.

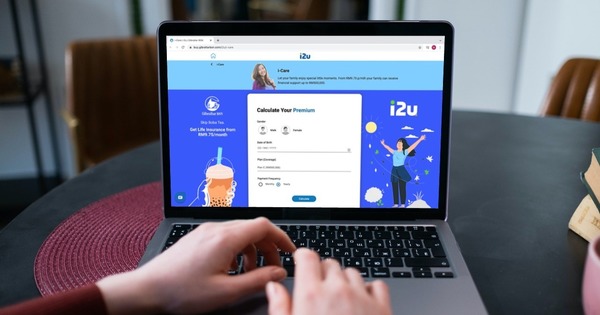

Just select and pay for your preferred plan online, all from the comfort of your own home. You can expect your policy to be delivered instantly through email too. Convenient, huh? 😀

Here are the plans you can choose from:

1. i-Protect and i-Protect Plus

Type: Critical illness coverage

Price: From RM7.60 a month*You can expect your basic needs and bills from critical illnesses covered when you opt for this plan. A lump sum will be payable to reduce your financial burden upon diagnosis of up to five critical illnesses. The plan covers cancer, stroke, heart attack, coronary artery by-pass surgery, and kidney failure. 2. i-Care

Type: Protection for death and total & permanent disability

Price: From RM9.75 a month*In the event of death, your loved ones can receive financial support of up to RM500,000, while a lump sum will be payable to reduce your financial burden should you experience total and permanent disability. An additional lump sum payment will be made to your family as well, if accidental death occurs.3. i-MedType: Affordable medical coverage

Price: From RM41.85 per month*With an annual limit of RM90,000, you’ll have your hospitalisation and medical bills covered under the premium you pay. This plan provides cashless and hassle-free admission into most major hospitals and medical centres. *Terms & conditions apply

The life insurer wants to reward customers who sign up for a plan on i2u, which is why it will be giving away 10 units of Apple Watch and 150 vouchers of GrabFood worth RM50 each, yay!

To spread the message on how insurance can help you gain a strong foothold into adulthood, Gibraltar BSN recently launched the Welcome to Adulthood campaign, comprising two videos — Jasa and Independence. These videos were inspired by true events of young adults taking their first step towards being independent.

Watch Jasa here:

Watch Independence here:

Accidents or illnesses can strike at any age, and it’s also important to sign up for one from a young age as your monthly premiums will be lower. As you get older, you can review your insurance coverage to ensure that it meets your lifestyle needs.

Gibraltar BSN also supports auto-credit for billing, so you will not need to worry about manually paying your premiums every month. 😉

Check out all our Spotlight stories to date here.