Follow us on Instagram, TikTok, and Telegram for the latest stories and breaking news.

As a parent, saving up for your kids’ future is probably one of your biggest priorities

However, with rising prices these days, it can be difficult to set money aside as we tend to be more preoccupied with current daily expenses. And yet, it’s still important to save up for the future, especially when it comes to your kids’ further education.

The cost of tertiary education can really add up, whether public or private, local or international. And the last thing you want is to deny your child the chance to pursue their chosen field due to a lack of funds.

We spoke to Malaysian parents to find out their top methods of saving money for their kids’ future.

Here’s what they had to say:

1. As a mother of five, Laila definitely finds herself struggling to set aside money for savings

Image via Laila Zain (Provided to SAYS)

“My husband and I have always lived paycheck to paycheck, and have never really been able to have long-term savings. At most, we have emergency savings, which we often find ourselves having to dip into.

“With things getting more expensive, our household expenses have increased tremendously. From basic necessities like cooking oil, rice, and milk, to kindergarten fees and school supplies, we definitely feel the pinch.

“On top of that, one of our kids is OKU so he requires extra support, and that actually takes up the majority of our finances,” shared the 35-year-old.

However, one thing she makes sure to do for each of her kids is to get them health insurance plans, which double up as savings plans

Image via Laila Zain (Provided to SAYS)

As the premiums are affordable and coverage continues for as long as you choose, she is able to automatically set aside that money for each of her children every month. And should they need it, the plans cover a wide range of health issues.

Laila’s recommendation is to get insurance for your little one during pregnancy itself.

Another long-term savings method of hers is to open ASB and Tabung Haji accounts in her kids’ names. Every year, she sets aside a portion of her work bonus to split between the children, as well as deposits the kids’ ang pows in their respective accounts during Chinese New Year, Hari Raya, and birthdays.

She and her husband never withdraw from those accounts, so the dividends just continue to grow year on year.

Image via Laila Zain (Provided to SAYS)

“It provides some peace of mind for me to know that I’m helping my kiddos grow their own nest eggs. I hope in the future, they can use the money if they need to make large downpayments, and/or continue to add to the funds and enjoy the dividends,” said Laila.

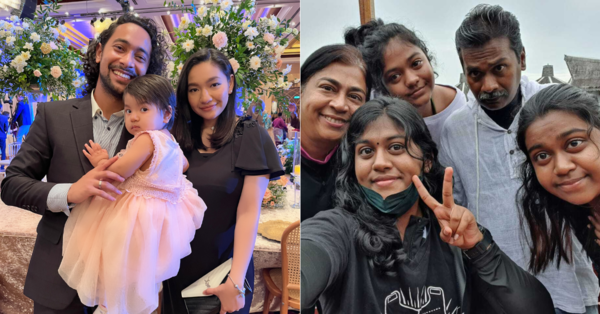

2. For 30-year-old Sabrina and her husband, they are constantly striving to balance their expenses with their savings

Image via Sabrina Zainal (Provided to SAYS)

“As my daughter gets older, the more we need to spend on her. Things like new clothes, shoes, toys, and babysitting fees really make it harder and harder to save up,” Sabrina explained.

Wanting to ensure that their daughter, the almost two-year-old Atteyya, is able to not only have a wonderful childhood, but also a stable future, Sabrina and her husband opened up a shared account for their daughter’s savings in the first trimester of pregnancy.

They also started extensively tracking their expenses — a method which has helped them greatly.

“We scrutinise every single price tag, even raw food items, whenever we go shopping,” shared the young mother, who is a news editor and presenter

Image via Sabrina Zainal (Provided to SAYS)

“Sometimes, we have to make do with less of a certain food (like fish or seafood) for Atteyya and our little family.

“My husband also takes public transportation more often to go to work just to save up on gas and parking since he’s working in KL, where it can cost up to RM15 a day to park his car. We stay put at home more often on the weekends now too and do things like watching movies at home for entertainment.

“We’ve even cut down on going on short trips/getaways, which kind of sucks, but saving money is a higher priority now,” Sabrina added.

According to her, this method of tracking their expenses has helped them survive until the end of the month without compromising on Atteyya’s future savings and her quality of life.

3. As a secondary school teacher, Clara is well aware of the importance of saving up for her kids’ education, which is why she started from when they were young

Image via Clara Skeetha (Provided to SAYS)

Speaking from her experience as a teacher, the 52-year-old noted how many parents fail to save up money for their children’s education, which leads to them being unable to continue their studies once they get accepted into university.

“It is just heartbreaking to hear when my students tell me that their parents don’t allow them to continue studying as they have insufficient money to further their studies,” shared the Kedah native.

That’s why when it came to her own three daughters, Clara made sure to start saving as early as possible.

Her method of choice? Opening a Simpan SSPN account, in which she deposited RM8,000 per year from the time her daughters were in secondary school.

Simpan SSPN is an education savings scheme by PTPTN that aims to help parents make financial plans for their children’s higher education.

Clara credits the Simpan SSPN account, which matured when her kids turned 18, with helping her ensure that her daughters were able to pursue their chosen fields of study. Not only was the dividend rate higher than fixed deposits from banks, saving in Simpan SSPN also entitled her to a tax relief of up to RM8,000 per year.

As a result, Clara’s eldest daughter was able to continue her studies in matriculation before going on to enroll in Universiti Sains Malaysia, and even secured a PTPTN loan for herself. Meanwhile, Clara’s second daughter managed to get a sponsorship from PETRONAS to further her studies, in addition to the funds from Simpan SSPN.

Image via Clara Skeetha (Provided to SAYS)

Clara’s advice to other parents is that it’s never too early to start saving up for your children

“I would advise starting a savings account for your children as early as possible. In my experience, Simpan SSPN is a great choice. Invest on a monthly basis and make sure to always have both a short-term and long-term budget so that you save enough money for them.

“I would estimate that you need to save up at least RM25,000 for your children if they want to go to a public university, and more for private universities, depending on the course they want to pursue,” she said.

For 25 years and counting, PTPTN has strived to make sure Malaysians are able to make their dreams come true and ensure that no student drops out of higher education due to financial constraints

Image via PTPTN (Provided to SAYS)

One of the ways they do this is through Simpan SSPN. Introduced in 2004, this long-term savings product aims to encourage parents to save for their children’s higher education while they’re still young.

In addition, saving with Simpan SSPN also earns you various special benefits such as annual dividends, income tax relief, and matching grants up to RM10,000, as well as free takaful protection and death benefits.

To encourage Malaysians to start saving early, PTPTN is running their Bulan Menabung Simpan SSPN 2022 this whole month!

From now until 31 October, there’ll be all kinds of exciting online activities you can take part in.

Here’s a look at some of them:

Image via PTPTN (Provided to SAYS)

Make sure to take part in Bulan Menabung Simpan SSPN 2022 to learn more about saving and stand the chance of winning some cool prizes!

Check out their website for more information.

You can also download the myPTPTN app via the App Store, Google Play, or HUAWEI App Gallery for more info about PTPTN.